The Vanishing Dream: Retirement in America

Many people today are confronting a stark reality: the looming retirement crisis in America. Picture this – a significant portion of our seniors, after a lifetime of hard work, find themselves barely scraping by in their ‘golden years’.

supporting links

1. America Has a Retirement Crisis. We Need to Make It Easier to Save [PEW]

2. SECURE 2.0 [Principal]

3. Will Your Retirement Income Be Enough? [Investopedia]

4. Americans need 53% more in retirement savings, higher than 4 years ago [CBS News]

5. Looming Retirement Crisis as Americans Struggle to Save [Social Security Report]

6. Americans will ‘work until the wheels fall’ [The U.S. Sun]

Contact That's Life, I Swear

- Visit my website: https://www.thatslifeiswear.com

- Twitter at @RedPhantom

- Bluesky at @rickbarron.bsky.social

- Email us at https://www.thatslifeiswear.com/contact/

Episode Review

- Submit on Apple Podcast

- Submit on That's Life, I Swear website

Other topics?

- Do you have topics of interest you'd like to hear for future podcasts? Please email us

Interviews

- Contact me here https://www.thatslifeiswear.com/contact/, if you wish to be a guest for a interview on a topic of interest

Listen to podcast audios

- Apple https://apple.co/3MAFxhb

- Spotify https://spoti.fi/3xCzww4

- My Website: https://bit.ly/39CE9MB

Other

- Music ...

⏱️ 14 min read

Many people today are confronting a stark reality: the looming retirement crisis in America. Picture this – a significant portion of our seniors, after a lifetime of hard work, find themselves barely scraping by in their ‘golden years’. Yes, you heard that right – retirement, once seen as a time of relaxation and enjoyment, has become a luxury for many. This is not just about numbers; it's about the lives of millions of Americans hanging in the balance. So, buckle up, because we're about to shine a light on a crisis that demands your attention. Yes, that means you.

Welcome to That's Life, I Swear. This podcast is about life's happenings in this world that conjure up such words as intriguing, frightening, life-changing, inspiring, and more. I'm Rick Barron your host.

That said, here's the rest of this story

At this time in our country, many people are navigating the complexities of single parenthood with two kids under their care. Each week is a delicate balancing act that for the lack of a better word is "juggling." Despite some people earning a comfortable salary hovering around the $80,000 to even $150,000 mark, the relentless barrage of essential expenses leaves little breathing room.

The 'juggling' encompasses all the mundane necessities we all face: groceries, car payments, mortgages, medical bills, children's clothing, childcare, and the list goes on, not to mention tackling unforeseen financial hurdles.

Many Americans' financial gaze is fixated on the present, where every penny carries significance. Nevertheless, some can't shake off the awareness that they're essentially deferring potential financial woes to the future.

According to Business Insider, just over half of Americans over the age of 65 are earning under $30,000 a year.

Retirement plans languish on the sidelines, overshadowed by the pressing demands of the present. Forecasting for the future seems like an impossible feat. It's akin to a perpetual skirmish; just when you believe you have a grip on it, another fiscal challenge arises.

For many people today, retiring at 65 appears distant and improbable. The prospect of financial stability remains an ongoing pursuit, a journey fraught with unexpected twists and turns.

The Impending Retirement Dilemma

Projections from the Bureau of Labor Statistics paints a very stark picture: the population of American workers aged 75 and above is poised to nearly double within the next decade, calling out a looming crisis in retirement readiness.

Once considered a sturdy three-legged stool, retirement savings in the United States have transformed big time.

· Pension Plans: The landscape now resembles a shaky balancing act, with traditional pension plans fading into obscurity. In the mid-1980s, approximately half of private sector employees enjoyed the security of defined-benefit pension plans. Fast forward to 2024, and a mere 15% are covered by such arrangements.

· Social Security: While Social Security remains a cornerstone, providing around 90% of income for over a quarter of older adults, its future is clouded by uncertainty.

A couple celebrating their retirement. Courtesy of: Yahoo

Social Security faces large and rising imbalances. Relative to the size of the economy, the combined annual cash shortfall for Social Security will climb from 0.5 percent of gross domestic product (GDP) in 2023 to 1.1 percent in 2034. Social Security faces a 75-year imbalance of 3.6 percent of taxable payroll, up from 3.4 percent as reported in last year’s report.

Without decisive action, it's slated for depletion by the mid-2030s, casting a shadow over the anticipated benefits of future retirees. Political gridlock has hampered meaningful reform efforts for decades.

Congress can make some decisions here, which, to be fair, may not make everyone happy, but doing something they are not. No one wants to be the bad guy. Fine, but making some tough decisions now, instead of waiting until around 2037, when Social Security will by default, cause a 20% cut in monthly payout. Yeah, my money is Congress will take the easy way out.

As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted. People that’s but 13 years away!

· 401(k): Left standing is the 401(k), accessible to 68% of private industry workers but utilized by only half of them. Larry Fink, CEO of BlackRock, sounded a loud and clear call in his recent annual investor letter, urging a concerted effort among corporate leaders and policymakers to reimagine retirement in America. He warned that failure to do so risks upsetting younger generations from capitalism and politics.

"The economic anxiety felt among younger generations, Millennials and Gen Z, is unsurprising," Fink noted. "They perceive the baby boomer generation as prioritizing their own financial interests at the expense of future generations. This sentiment rings particularly true in the realm of retirement planning."

Fink advocates for reevaluating the traditional retirement age and expanding access to investment vehicles and 401(k) plans as potential solutions. Such measures address societal concerns and align with BlackRock's vested interest, as over half of its $10 trillion in managed assets are earmarked for retirement purposes.

401(k)s: An Unexpected Lifeline

For many Americans, saving for retirement feels like a distant dream, particularly as recent data from Bankrate reveals that just 44% of US adults can cover an emergency expense exceeding $1,000 from their savings.

The confluence of factors such as soaring inflation rates, the resurgence of student loan obligations, and the gradual depletion of pandemic-era savings has left many individuals struggling with financial uncertainty.

Amidst this economic turbulence, a significant portion of the populace has found themselves resorting to their 401(k) accounts as a source of relief in times of financial distress, often at great cost. According to a recent survey conducted by Vanguard, premature 401(k) withdrawals are on the rise, accompanied by hefty penalties.

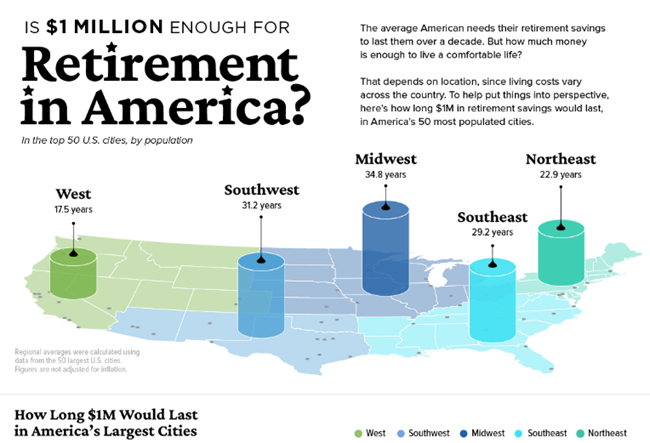

$1 million enough for retirement? Courtesy of: Visual Capitalist

To put this in perspective, if you need $50,000, you’d need to take out $70,000 to cover the penalty fees. There are other savings options, but Delaware State University's Professor Nandita Das says they are not enough to live off of. “Whether it is pension or social security, people may think social security will pay for retirement, but it is just for meeting the bare minimum requirements. Social security is to help you go buy a McDonald’s meal,” said Dr. Das.

While researching for this episode, I came across an article regarding a 54-year-old single mother employed as a legal administrative assistant in Texas. Her journey captures the plight of many forced to dip into their retirement savings to navigate life's unpredictable twists and turns.

The first instance occurred shortly after the birth of her son, when this individual, confronted with a job devoid of maternity leave benefits, faced the harsh reality of income loss. Returning home from the hospital, she was greeted by a letter from her employer, stating their unwillingness to preserve her position during her anticipated absence.

All of a sudden, she found herself without work, with no support from her son's father. That's when she made the difficult decision to tap into her 401(k) to sustain her and her son while she searched for new job opportunities.

Years later, she found herself in a similar predicament during a job transition period. With mounting expenses, a looming relocation, and lingering credit card debt, she once again turned to her retirement savings.

Despite this person’s resilience, they still find themselves caught in the cycle of living

paycheck-to-paycheck, with now only $15,000 remaining in their 401(k) account.

For this single mom and one son, the 401(k) serves not as a beacon of retirement security but as a makeshift buoy in the very rough sea of financial uncertainty many are facing today.

I would guess there are thousands of stories like this one out there.

Retirement Concerns in an Electoral Climate

As the November elections draw near, the specter of retirement insecurity looms large in the minds of American voters.

In a recent interview on CNBC, former President Donald Trump hinted at the possibility of scaling back Social Security and Medicare, suggesting avenues for entitlement reform. President Joe Biden swiftly countered with a resolute "Not on my watch," as echoed in a campaign-produced clip, " reacting to Trump's remarks.

Karoline Leavitt, spokesperson for the Trump campaign, clarified Trump's stance, asserting that his remarks pertained to curbing inefficiencies rather than slashing entitlements. Sure.

In December of 2022, the Biden administration ushered in SECURE 2.0, aimed at incentivizing employers to provide retirement benefits and easing barriers to savings. Additionally, the administration proposed regulations to curb excessive fees in retirement investments, signaling a proactive stance toward bolstering retirement security.

Senator Bernie Sanders of Vermont sounded the alarm on retirement inadequacies during a recent hearing, highlighting the plight of seniors subsisting on meager incomes. He advocated for a return to traditional pension plans, contrasting sharply with the investment-focused approach advocated by BlackRock's Fink.

The American people are closely monitoring the rhetoric surrounding retirement issues from presidential candidates to local contenders. For some, putting money into a 401K is not doable. Even those who have say a 401(k) nest egg totaling around $360,000 to $500,000—well above average—they remain acutely aware of its insufficiency.

Expressing doubts about the feasibility of retiring comfortably, people intend to prolong their careers until at least 65 to qualify for Medicare. However, they harbor skepticism about any political candidate's ability to deliver a viable solution to the retirement problem.

While it would be ideal for the situation to improve, many Americans are not optimistic at this point in their lives. For the majority of Americans, their hope is simply to prevent the looming retirement crisis from deteriorating further.

What can we learn from this story? What's the takeaway?

Planning for retirement is not something you want to do shortly before you stop working. It's a lifelong process. Your planning will undergo a series of stages throughout your working years. You'll evaluate your progress and targets and make decisions to ensure you reach them.

A successful retirement depends not only on your ability to save and invest wisely but also on your ability to plan. How much income you'll need in retirement is hard to know and tricky to plan, but one thing's for certain. It's far better to be over prepared than to wing it.

Well, there you go, my friends; that's life, I swear

For further information regarding the material covered in this episode, I invite you to visit my website, which you can find on Apple Podcasts, for show notes calling out key pieces of content mentioned and the episode transcript.

As always, I thank you for the privilege of you listening and your interest.

Be sure to subscribe here or wherever you get your podcast so you don't miss an episode. See you soon.